P&C insurance industry leaders are looking forward to anticipating the changes that will affect insurance companies in the near future and preparing to react with agility. The better the data on current and upcoming trends, the more prepared a business can be, and the better the long-term outcomes - from customer acquisition and retention to efficiency and profitability.

Some trends expected to have a large impact on P&C insurance industry businesses include automation and AI, expanding use of the cloud, and increased reliance on data-centric insurance ecosystems.

Automation & AI

According to research from Deloitte, 65% of insurers increased investment in robotic process automation (RPA) in 2022, while 74% increased investment in AI1. Together, these technologies are used to automate repetitive manual tasks so that valuable human resources can be channeled toward higher-level, strategic outcomes.

Cloud modernization

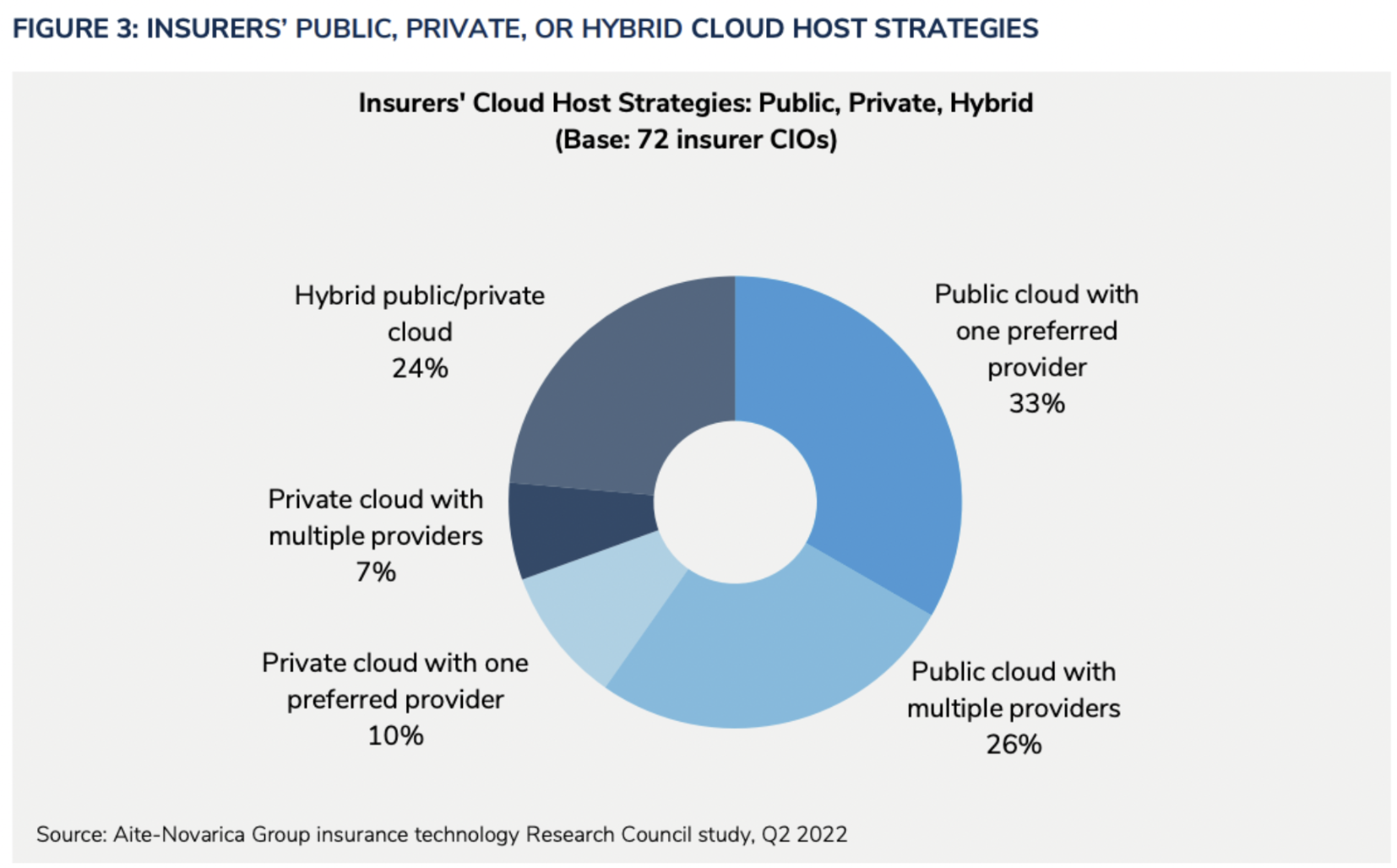

91% of insurance companies surveyed by Novarica have some part of their data or processes hosted in the cloud. And 80% of insurers are investing resources toward expanding their use of cloud in 2023.

Insurance companies prefer the public cloud over private, with a fairly even division between the public cloud with a single provider (33%) and the public cloud with multiple providers (26%). The primary benefit of expanding the use of cloud technology is to improve agility, a need that has been highlighted over the tumultuous events of the past few years.

Data-centric insurance ecosystems

According to McKinsey, data-centric digital ecosystems will account for 30% of revenues in the global insurance industry by 20252. These omnichannel systems will reduce friction across the customer journey, with the capacity for seamless cross-channel interactions and self-service options.

At the same time, insurance ecosystems are scalable so that businesses quickly take advantage of growth opportunities. Finally, an ecosystem that is built on trusted relationships between partners throughout the industry allows businesses to be more agile and offer a variety of customized services and products to their customers - a significant competitive differentiator.

A report from Accenture says that 82% of insurance executives believe that insurance ecosystems allow them to grow in ways that would not otherwise be possible, with 58% actively seeking out ecosystem opportunities and new business models3.

Read more: APIs vs. Microservices: What’s the Difference?

The insurance industry is growing more complex, with competition increasing between industry leaders, new entrants, and all those in between. If you are in the midst of your own digital transformation, to gain a competitive advantage or improve services, consider Solartis.

Our company offers policy administration microservices available as SaaS or PaaS models, as well as comprehensive BPO services backed by experience and technology.

Contact Solartis today to discuss your challenges and how Solartis can help you reach your business goals in 2023 and beyond.

"They are fast, simple, and cost-effective. Their team is an extremely reasonable group of people who care, really care, about your success. Every launch has some bumps - they worked above and beyond to make sure those bumps didn't disrupt our launch or our ability to write new business. Without Solartis, I wouldn't be projecting a 30% increase in topline growth."

said Cameron Linder, CEO, Western Bowling Proprietors Insurance (WBPI), Rednil Insurance Brokers, Inc.

Sources:

- https://www2.deloitte.com/content/dam/insights/articles/US164650_CFS-Insurance-industry-outlook/DI_Insurance-industry-outlook.pdf

- https://www.mckinsey.com/industries/financial-services/our-insights/insurance-beyond-digital-the-rise-of-ecosystems-and-platforms

- https://www.accenture.com/us-en/industries/insurance-index