Still not sure how Solartis microservices can help?

Contact a member of the Solartis team.

Initial Product Configuration

Builder Toolkit

Low-code toolkit for initial product configuration.

Implementation Services

Solartis professional services for your initial implementation.

Requirements Analysis

Our methodology for defining your initial product requirements.

Implementation Methodology

Our implementation methodology for initially configuring your product.

Ecosystem / Integrations

Check out our growing list of ecosystem and integration partners.

In Production and Ongoing Maintenance

Self-Service Builder Toolkit

Self-service low code toolkit for insurance product maintenance.

Report

Solartis reporting and analysis tools and options.

Explore

Book of business level “what if” analysis and bulk policy changes.

Monitor

Full system monitoring services and tools (24/7).

Solartis Administer

Transaction professional (BPO) services.

Search

Stay ahead of the upcoming changes in the insurance industry and learn more about how Solartis products and services can improve your business and reduce challenges.

CHIC (an automotive insurer) was limited by inefficient, manual, paper-based processes; and needed a faster, simpler policy administration system to remain competitive, better serve existing customers, and support growth. Learn how CHIC reduced the time and cost of automotive insurance processing.

Solartis recently partnered with BriteCo to create a unique value-adding insurance technology ecosystem for jewelry insurance leveraging microservices. Learn how BriteCo extended its tools and third-party platforms in 6 months with microservices technology.

Deploy innovative insurance products with maximum speed. Create unique sales and policy administration systems in half the time.

.png)

Digitization, mobilization, and emerging technologies are forcing insurance companies to rethink their traditional roles and business models entirely.

See which trends are moving the insurance market this year and beyond and what impact they may have on your business.

The property and casualty insurance space is changing. Customers and their expectations are growing and becoming more demanding, competition has increased, and advances in technology are forcing insurers to rethink strategies and operations.

Future-proof your insurance system with a modern, microservice-enabled, and market-tested policy administration software.

With the use of microservice architecture, they can now replace costly components, extend, orchestrate, and collaborate with third-party providers to create unique sales and policy administration systems in half the time.

BPO can help P&C insurance companies eliminate administrative backlog, improve turnaround times, and streamline operational processes for better customer satisfaction.

Solartis team members work side by side with your operational and underwriting staff. Our goal is to free up your staff from time-consuming administrative activities. We are experienced in every task associated with insurance administration.

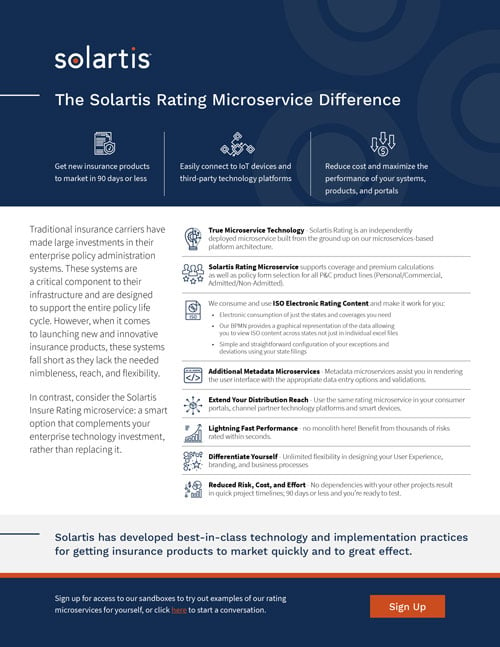

Apply the latest developments in software architecture to your insurance rating to reduce project risks and maximize speed-to-market.

Advanced policy administration support combining people and technology. CHIC (an automotive insurer) was limited by inefficient, manual, paper-based processes; and needed a faster, simpler policy administration system to remain competitive, better serve existing customers, and support growth.

Learn how BriteCo extended its tools and third-party platforms in 6 months with microservices technology.

Save Over 35% of the Cost and 39% of the Overall Time Spent Analyzing and Interpreting ISO Updates.

.png?width=540&height=704&name=Solartis_CTA_contact1080%20(1).png)

Are you looking for a fast, easy-to-use solution for creating and managing P&C insurance products? The Solartis Product Management Toolkit (PMT) can help your company. Watch our 4-part tour of the Solartis PMT.

Future-proof your insurance system with a modern, microservice-enabled, and market-tested policy administration software.

Contact a member of the Solartis team.