1: The Solartis Builder

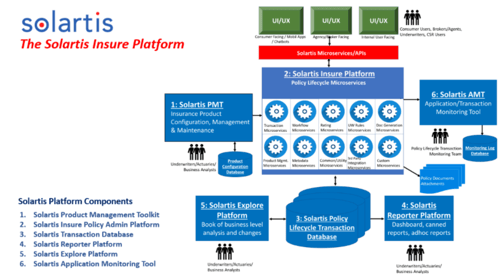

All Solartis Insurance products are developed and maintained in the Solartis Builder. The Solartis Builder is built specifically for insurance, and just like Solartis Insure, the Solartis Builder is built entirely on the cloud, with no legacy applications. Here is a high-level overview of the Solartis Builder's components and capabilities:

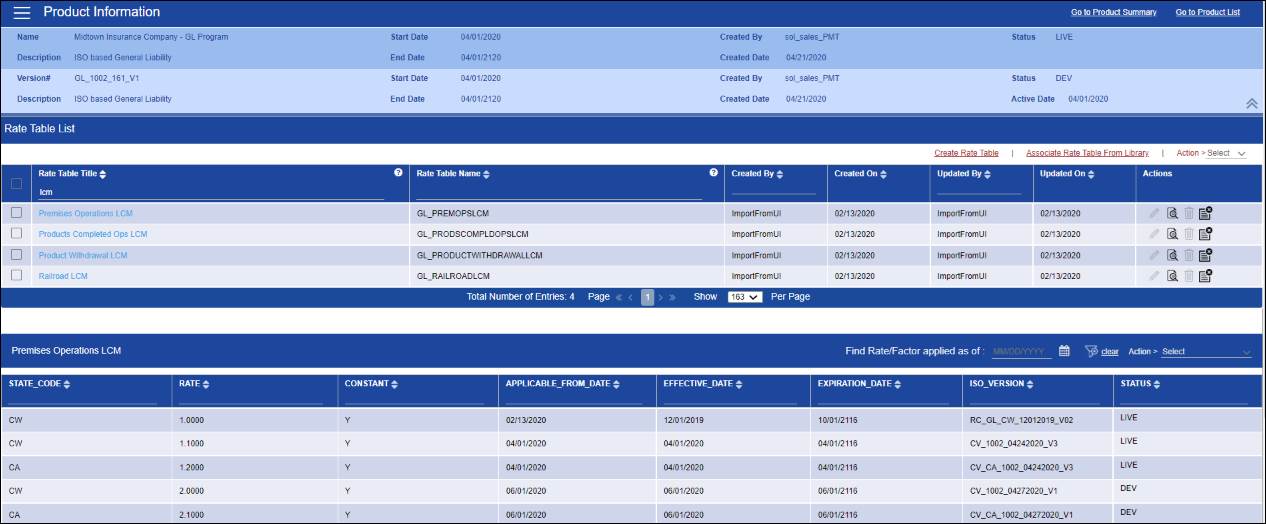

1a: Create Insurance Products: A new insurance product can be either configured from scratch or can be created from a base insurance product; or from a bureau-based product like ISO ERC. Solartis contains the complete library of ISO ERC content, digitally consuming all ISO ERC countrywide and state-specific files into the Solartis platform. Via Solartis Builder, all ISO ERC content (states, coverages, rate tables, algorithms, forms selection rules, and stat codes) is accessible for customers to manage and use. An insurer can view, analyze, and manipulate all ISO data across all states via a graphical representation of the data or through downloadable spreadsheets. An insurer adds its carrier rate and rule exceptions and its carrier-specific forms, then tests and deploys the ISO-based product(s) into production.

1b: Maintain Insurance Product(s): An insurer uses the Solartis Builder to manage all aspects of their insurance products; they can create and manage products and product versions, states and state deviations, coverages, rate tables, lookup tables, UI/UX pages and attributes, all documents, associated forms, processing rules, and algorithms.

1c: Configure, orchestrate, maintain, and test your microservices: The Solartis Builder is used to configure, orchestrate and maintain all needed microservices. The Solartis Builder also provides the ability to test on the individual microservice level.

1d: Promote: Solartis has one environment for development, testing, and production. Changes can be created, tested, and deployed into production using the Solartis Builder by business users without any need for additional DevOps resources.

1e: Activity Log: Solartis Solartis Builder provides a full audit trail of all changes made to insurance products, as well as an activity log of who performed the changes and when.

2: Solartis Application Monitoring Tool

The Solartis Application Monitoring Tool (AMT) allows Solartis to be proactive rather than reactive when it comes to potential system issues and/or problems. The AMT is a tool used to monitor all Solartis customers’ production environments, ensuring services are always up and running efficiently. Solartis monitors on a 24/7 basis for potential failures or performance issues including failures related to third-party system integrations. The system is used by the Solartis Application Monitoring Team and is also extended to Solartis customers so they can monitor their activities themselves.

3: Solartis Explorer

Solartis also provides The Solartis Explorer Platform which allows Solartis or the customer to run various “what-if” scenarios on a book of business level versus the individual policy level from either the Solartis Insure Platform or from other third-party systems.

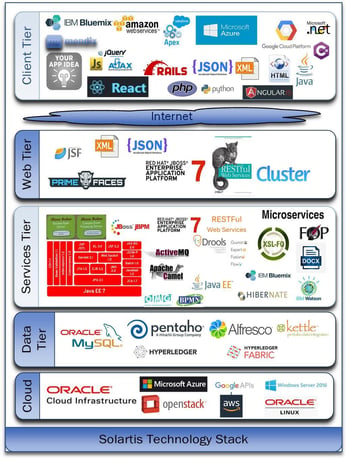

The Solartis Insure Platform is Designed, Developed, and Deployed based on a microservice-driven architecture model.

The Solartis Insure Platform is Designed, Developed, and Deployed based on a microservice-driven architecture model.